Calvinball

10/23 OpenView Capital Markets Roundup

If this email was forwarded to you, please consider subscribing here!

Lastly, we believe the go to market effort to sell into new buying centers should be a further tailwind to an impressive cloud DBNRR of >130%. We believe Splunk’s current ARR growth of 50% at F2Q at nearly $2bn in scale – and further guidance for a 3-year ARR growth CAGR of 40% - remains under-appreciated by the market.

No, that isn’t a typo. Yes, Splunk has a cloud business growing 50% with a 130% dollar-based net retention rate (one which passes my definitional sniff test) and is guiding the Street to sustained 40% growth over the next three years. And no, Splunk isn’t trading for 30x revenue. In fact, it is trading a turn below the median public SaaS multiple at just 13.5x NTM revenue. All of this data was wonderfully positioned by company management in a recent Analyst session (deck linked) and is an interesting read. The narrative a company tell the markets starts with how the management team actually runs the business.

What is so brilliant about what Splunk has done is the level of transparency in their disclosure and the fluency with which they articulated the narrative going forward. They’re talking about ARR. They’re talking about net revenue retention. They’ve added detailed breakouts of ARR vs. perpetual license mix shift vs. SignalFx. Towards the end, there is even a cash flow bridge (outlining perpetual to SaaS). Management has broken down the business and strategy in an approachable way – and it is obvious they are, as others have noted, "figuring out the metrics that really drive their business and helping the investors understand how they’re going to run their business based on these metrics.”

Splunk is a good example of how “Boards need an investor perspective.”

Some companies do this well, but many still do it very poorly. As one contact pointed out to me, Workday still doesn’t disclose retention! Alteryx flipped back and forth between guiding on ARR, then 606, then back to ARR as it suited the business - that doesn’t give long term holders confidence. That a software business in 2020 would choose not to share retention with the Street outside of fleeting hints at what it could be during earnings calls is bizarre. Alteryx’s 40% fall from nearly $180 / share after Q2 earnings was mostly due to a lack of investor understanding of their financial model – not something more sinister related to the long term thesis on the business (that I can identify).

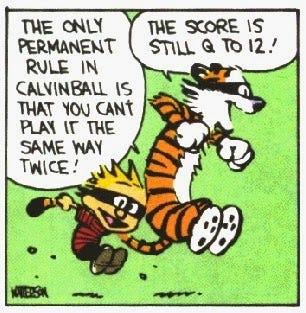

While reports of the death of value investing may be greatly exaggerated maybe what value investing is in software today is just recognizing that 30x revenue is, in fact, really expensive! And similarly acknowledging that if software markets are as large as we’ve been led to believe then there can be value in finding software businesses just figuring out the rules of Calvinball - where the only rule is that the rules are always changing. Finding companies like Splunk that underneath the hood are generating really compelling metrics, but haven’t figured out how to communicate that opportunity yet (haven’t yet changed the rules). The intrinsic value – the present value of future cash flows – of Splunk is much greater as a recurring revenue software business, and should they pull off what they’ve outlined they can turn a sleepy business “losing” to new observability players into one with top quartile metrics, and valuation should expand. How many more public software companies out there are just waiting for a great storyteller?

OpenView SaaS Benchmarks

Our 2020 report is launching in a few weeks! In the meantime, I’m excited to share some preliminary insights. When my colleagues Kyle Poyar, Dan Knight and I were preparing the 2020 benchmarking survey, our biggest question was: "How did COVID-19 and the economic downturn affect private SaaS companies?" Here’s what we found:

👉 Growth rates remained surprisingly high, proving again that SaaS products are sticky and recession-proof. Microsoft's Satya Nadella commented that we "experienced two years of digital transformation in two months."

👉 Folks prioritized their existing customers. Expansion dollars are far more profitable than net new ones. Despite some uptick in churn through COVID, net dollar retention was as strong as ever.

👉 Companies got more efficient with their spend. Sales & Marketing dollars in particular were pared back as companies focused on their core rather than going after experimental bets that might have distracted them. CAC payback periods remained quite healthy.

SaaS is proving to be incredibly resilient through this crisis. Given the recent exuberance in private and public market valuations, you could even argue that SaaS companies over-corrected in 1H 2020. Buying behavior remained strong, demand didn’t go anywhere, only company resources focused on selling into that demand did. This would've been hard to predict back in March-April. Either way, it's time for companies to hit the gas again or risk being left behind by their competitors!

Market Update

There are lots of “late stage” behaviors emerging, per Bireme Capital. These include retail traders speculating not just on equities, but volatile derivatives (options), institutions also participating in the derivative madness, the embrace of stock splits, and SPACs (including those with no revenue - “there is a bigger burst of no revenue $1B + companies going public than at the dotcom peak”). Otherwise, I enjoyed this data analysis visualizing the correlation between SaaS multiples and interest rates. From a pure finance perspective the implications of a lower discount rate on valuation is obvious but the trend in the data is a lot less obvious. As the author notes, “most surprising is how closely multiple expansion is related to the advancement of time.” The rapid growth and improvement in understanding of software business models and the more recent dearth of opportunities is driving more and more capital to the sector, pushing valuations up. It isn’t just rates, but more so multiple expansion driven by the allure of easy stock returns in high growth sectors. Public markets ended the week with little movement – the market is begging for a stimulus to break out, but it still remains unlikely we see it before the election (SaaS -0.04%, Dow -0.95%, NASDAQ -1.35%, S&P 500 -0.53%).

Economic Data

Not much new here, but I did read a great report from Bank of America this week which covered key data on the virus, aggregate activity, consumer behavior, the labor market, and much more. One standout quote: “With the economic data pointing to a moderation in activity, we remain very concerned that the recent surge in new virus cases will hinder the economic recovery. Moreover, we fear that states that have experienced relatively stronger economic recoveries are those currently experiencing the most severe virus outbreak. This could lead to an increase in voluntary social distancing in these states or government mandated measures to restrict activity.”

What Else We’re Reading

Assessing the value of a company’s real options. Coming Into Focus. Logs, Tails, Long Tails. Upside-Down Markets: Profits, Inflation and Equity Valuation in Fiscal Policy Regimes. Alpha and the Paradox of Skill.