We notice that we operate in a world where many market participants focus on stories, tickers, valuation ratios, and price trends. Yet, behind every ticker and ratio, there is a real company…people and resources that comes together in a unique way to create or destroy capital. We believe it is this quality, the company’s ongoing ability to generate cash—and not its current price, price trend, P/E ratio, or analyst rating—that will ultimately determine the company’s longevity and value.

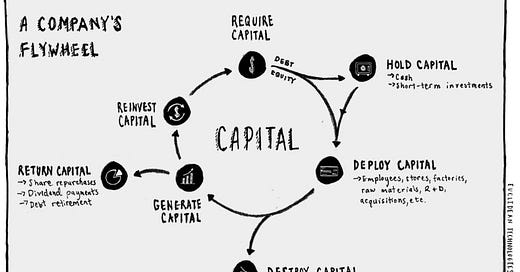

In “What Are These Things We Call Companies,” Euclidean Technologies outlines the Company Capital Flywheel. Visualizing how capital is used, and value is created. Companies require capital, they deploy that capital, often destroy that capital, but hopefully generate capital they can then reinvest or return to their shareholders.

As we consider the traditional venture backed software model - it is equity, equity, equity in the “require capital” section of the above company capital flywheel. As I’ve said before most of our favorite software business are funded with equity (very little debt in the capital structure). There is zero downside to selling equity… in that it can and will go all the way to zero (needn’t be repaid) if the business fails which makes it favorable, in particular for early stage (venture stage) business with unproven business models and markets for which traditional financing (bank debt) isn’t an option.

But as software markets have evolved and investors and lenders have matured in their understanding and reviews of business models - valuations have risen. So ideally we’re past just equity (and maybe risk is reduced). New models are emerging: recurring revenue syndication, shared earnings agreements for companies, and venture debt a more aggresive market than ever - there are many ways for founders to finance their business. But despite this, most companies still can’t say no when an investor is banging down the door to invest new - very expensive - equity into their business.

In fact, there is significant downside to equity. It’s really expensive.

I don’t care if you believe Bill Gurley’s “IPOs are the largest single day wealth transfer” positioning or not - what is important and I think lost in his ranting against the IPO pricing mechanism is that for some reason, in the software world, folks are comfortable with horrible capital allocation decisions. Perhaps it is because software companies broadly are able to create value at such rapid rates that when they sell equity their own valuation keeps rising and the cost isn’t noticed. Perhaps all software companies are perpetually undervalued and we’re in a long term tech bust. Perhaps it is just the equity hamster wheel - the “old way of doing things” - that companies and their boards can’t look past. It just doesn’t seem that enough folks are focused on making great capital allocation decisions, and investors are profiting. Just look at how much Dragoneer was able to make in 7 months on Snowflake (5.8x’d their money)!

Most struggle to see the forest through the trees of how this impacts their own wallet. So, no longer should software executives search for just the next lettered round - think bigger. There are many ways to finance your business. And for the employees on the front lines: think bigger. Each decision you make has trades offs - is a blue button the highest priority, or is the red button? Which will create the most value? From the Board, C-Suite, all the way down - we’re all making capital allocation decisions and whether we’re “operators” or “investors” - we’re all trying to be great capital allocators.

The Latest From OpenView

This week on OpenView’s BUILD podcast Blake spoke with Brian Rothenberg, a Partner at the early stage venture capital firm, Defy. Brian was at Eventbrite for more than 6 years - from startup through IPO - while the business grew all the way to $300M revenue and a nearly $3B market cap, all while serving as VP of Growth and running a $100M+ revenue line as GM. On the episode Blake and Brian speak about:

How Eventbrite’s growth model created a viral loop that led to massive success

Building a distribution advantage (and the biggest pitfalls of not)

Going from siloed to a cross-functional approach to org and product design

Market Update

The most exciting news, as was alluded to above, was the largest software IPO ever: Snowflake. The business closed on IPO day 120% above offering price, and is currently trading at a perfectly reasonable ~150x trailing revenue. Again, most companies like Snowflake are performing just as expected at the beginning of 2020... they’re just valued 4-5x+ more than anyone could have anticipated (multiple expansion). 2020 has been interesting. Elsewhere, Apple has quietly fallen 22% from its peak which has also dragged down the NASDAQ - extremely quietly, amidst some companies trading for >100X revenue - into correction territory. This is second straight week of declines, but I still caution against fearing of anything sinister. The market was too hot for a while, and while the NASDAQ is down 10.5% from its early September high… it feels healthy!

Indices finished down (SaaS +0.00%, Dow -0.03%, NASDAQ -1.36%, S&P 500 -0.64%).

Economic Data

Two key updates to know from this week. 1st, the Fed holds rates steady and promises to stay there for years. Which roughly translates to, “Fed gives market permission to keep partying like it's 1999.” The Fed also announced a new approach to inflation in that they will be willing to “allow inflation to run hotter than normal in order to support the labor market and broader economy”. This (1) gives us an indication that the Fed expects the US to enter a period of inflation exiting this recession and (2) suggests the interest rate forecast is likely no joke. The Fed is serious about recovery.

As James Gross noted, “in the 21st century, we have fought through 3 recessions. The USA has the best tech and will have the greatest acceleration of tech adoption in our lifetime because of a once-in-a-century pandemic. Rates are geared towards forced investment and the pandemic shines a light on inequality and investment needed in infrastructure to solve issues like housing, health (personal + planet), and better mobility.” While there is much to worry about, the Fed continues to be very clear in their intentions to support the country, and there is good reason to be long USA.

What Else We’re Reading

One Job: Expectations and the Role of Intangible Investments (and if this is of interest, this piece on Microsoft I shared a few weeks back is also a paper worth reading). Remote work is a pure negative. And we’re listening to “Annie Duke – How to Decide (Capital Allocators, EP.156)”. Stimulus was “also a banking bailout”, per the Fed.