Christ(M&A)s came early

12/4 OpenView Capital Markets Roundup

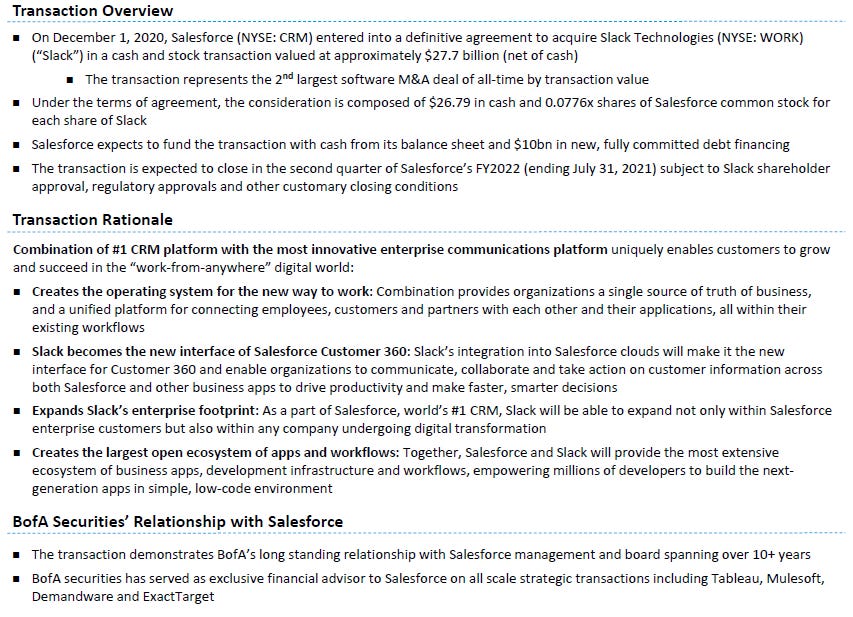

Did anything big happen this week? Something crazy like Salesforce signing a definitive agreement to acquire Slack for $27.7B? I had to triple check I wasn’t dreaming before sending this – but yes, that did happen. Transaction overview:

Another strategic acquisition! I find immense humor that Salesforce – the same Salesforce whose CEO claimed in August “we’re not in a good M&A environment” – went out and spent the most (and for an acquisition of scale, the highest multiple) the company ever has in a 50% stock deal (and as Salesforce stock is arguably undervalued, this is arguably more expensive) for just a ‘chat product’. Any number of buyers (Zoom for instance) seem to make more sense, and the revenue would be more valuable elsewhere today. That said I do like this deal strategically - not so much financially.

I mentioned it in July, but generally the key to sustained valued creation in software – the moat – is high switching costs. But there is also a less discussed moat: distribution. On the former: why do sales leaders buy Salesforce over and over again? Switching to other systems once you’re trained and experienced is costly (searching, training, implementing, etc.). Salesforce is honestly just a shiny UI web-app on top of a simple database (fortunately no longer an Oracle database). So as enterprise IT buyers shift from executives to users, Salesforce has seen the light and realized they need to address end users too. Gone are the days of the CIO sale with a rep hopping on a plane to sell a Salesforce license over a steak. Salesforce is for now still the system of record but the place where work happens is no longer there. End users come first, and the decision makers (end users) are getting locked into a new kind of UI: chat. Salesforce is staying ahead of this shift in buying Slack. On the latter, Salesforce has an advantage in that it can plug this new product into its existing sales team and distribute to all of its customers tomorrow. For a product that is now in the steep part of its adoption curve, this means Salesforce can drive rapid returns and likely accelerate Slack’s growth. But there is some risk here then for Salesforce. If CRM can quickly distribute Slack and have it be a place where people interact internally and externally and it becomes the new UI and system of record for all things CRM – they’re replacing their current product with one that really does the same exact thing at a fraction of the ARPU today. And Microsoft Teams is still a real threat. Some of course don’t like the deal and I get it: this isn’t a silver bullet for CRM vs. Microsoft. Regardless, I believe it to be a strategically sound deal.

There are two kinds of businesses: The first earns 12%, and you can take it out at the end of the year. The second earns 12%, but all the excess cash must be reinvested — there's never any cash… We hate that kind of business. -Munger

But not financially. Software companies require a lot of capital to sustain growth (valuation) at scale. The notion that every company will grow fast for a while and then generate 20%+ growth and FCF margins eventually because software is sticky is ~theoretical. Despite claims that “>100% net retention is free growth,” it isn’t. Companies must deploy incremental capital to sales and marketing to drive retention and expansion as well as to product to maintain the platform and innovate on the new features and functionality. All so customers keep buying (more). Salesforce’s free cash flow margins are indeed strong historically… but P&L focused investors miss the massive dilution (cost) obscuring the value that is apparently being created by revenue growth. In fact, “In the 1H of FY2020, Salesforce's FCF/share decreased by 23%. Meanwhile, the price per share has appreciated by 77%.” As my calls for more M&A are heard and more capital is deployed software investors need to look more closely at the statements beyond the P&L. Yes, Salesforce can plug Slack into its distribution channels and accelerate topline growth with greater operating leverage - but is this growth worth the cost to shareholder value?

While some, myself included, rolled our eyes at the idea of “MT SAAS” – there is obviously merit to the idea. Given the moats and capital advantages of incumbents, these businesses are evolving to be the cathedrals of the modern world. Enterprise software is now the place where people come together to do their work better, and these companies will be built over a very long term. I expect that M&A will continue as more companies get to scale and it becomes the highest value means of capital deployment. So to be long a ‘MT SAAS’ stock is to own a call option on other software companies (to be short innovation). In a world where you can own a company for 50x revenue or Salesforce for a reasonable teens revenue multiple and the others eventually – why not just buy Salesforce… or better yet, stick with one of the many cloud computing indices that will surely compound nicely over decades.

The Product-Led Organization

This week on OpenView’s BUILD Podcast, Blake spoke with Francesca Krihely, Senior Director of Developer Experience at Snyk. Francesca shares her best practices on creating a community that resonates with developers. She discusses how Snyk is taking a PLG approach to security, how “community marketing” became a winning strategy at MongoDB (Francesca’s previous company), and how to build and scale a developer community that accelerates growth and product adoption. Just in case the BUILD podcast isn’t already top of your favorite podcasting app, you can listen to the episode here.

Market & Economic Data

The public market indices (save for the SaaS index) had a strong post-Thanksgiving week: SaaS +1.34%, Dow +1.03%, NASDAQ +2.20%, S&P 500 +1.67%.

On the economic side, there was new info on jobs this week and per President-elect Biden the data was “grim”. Non-Farm Payrolls were 245k vs. 470k expected, and the pace continues to slow. On the continuing unemployment claims side – while this number remains unusually high – it has continued to fall. Contrasting slowing job growth vs. high continuing claims suggests perhaps we should be more aggressive with stimulus. The economic damage was predicted by many (I’ve mentioned it weekly for a few months now) but it still seems as though folks didn’t believe it or simply hoped it would go away.

What Else We’re Reading

Median duration of unemployment. To Buy Or Not to Buy. Chase card data show a sharp fall in spending during the Thanksgiving.. weekend, with notable weakness in restaurant spending. US total call option volume. Crickets.