In Compound Advisors’ “No Country for Old Yields” the firm writes that “Over the past 40 years, there has been a one-way trend in US Treasury Bond Yields: down.” As I’ve noted, this has played to the favor of software investors (the valuations of long duration equity assets are much more sensitive to interest rates). Falling yields have forced many into mostly equity portfolios. As the quote above gets at: how else would you build a balanced portfolio when on an inflation-adjusted basis, bonds lose you money (and will continue to into the future)? Besides just swallowing the all equity allocation risk, perhaps taking the “barbell approach,” or maybe thinking about investing in all types of luxury goods (cars, watches, shoes) or bitcoin could work.

Or maybe even private funds?

As has been noted in spectacular detail, over the past quarter century there has been a marked shift in U.S. equities from public markets to private markets controlled by buyout and venture capital firms. I don’t need to tell most of this audience how much equity value has been created in private markets. In the linked report, Mauboussin even acknowledges that returns are better in privates historically (power law dynamics of venture aside). So then perhaps as accredited investors rules relax, maybe the right way to balance a portfolio is by investing more money into private companies?

If private market investments do indeed continue to grow in popularity, there’s two important topics to explore: (1) illiquidity’s impact on returns and (2) expectations.

As Matt Levine notes “because conventional theory suggests that if investors prefer illiquidity over liquidity, then they overprice illiquid assets, which means that those assets’ expected future returns are lower.” Returns in the private markets may actually be worse than a comparable basket of public securities (if that were possible for early stage opportunities, just suspend disbelief). Investors actually place a premium on stability, or as Cliff Asness alludes “perhaps it is at least psychologically soothing for the private investors to not have to worry about stock-price volatility, and they are willing to pay up for the pleasant experience of not being told they’re losing money.”

And as more capital flows to illiquid, private market investments, this also throws into the spotlight a very different expectations investing game in the private markets. There aren’t 1000s of Robinhooders and hedge funds that can go long or short your equity on whim (that frequent volatility private investors are psychologically protected from). So, no longer can an expectations miss be eased by gaining back the Street’s trust over a few quarters. If the treadmill slows or stops it could spell the end for a private company whose stock doesn’t trade frequently on the equity hamster wheel.

With the Fed being so clear in their intentions for interest rates, our old portfolio construction rules of thumb need to be thrown out the window for the foreseeable future. Treasuries won’t cut it in any portfolio. I’m not sure what that means quite yet, but it’s worth everyone contemplating.

PLG Outperformance

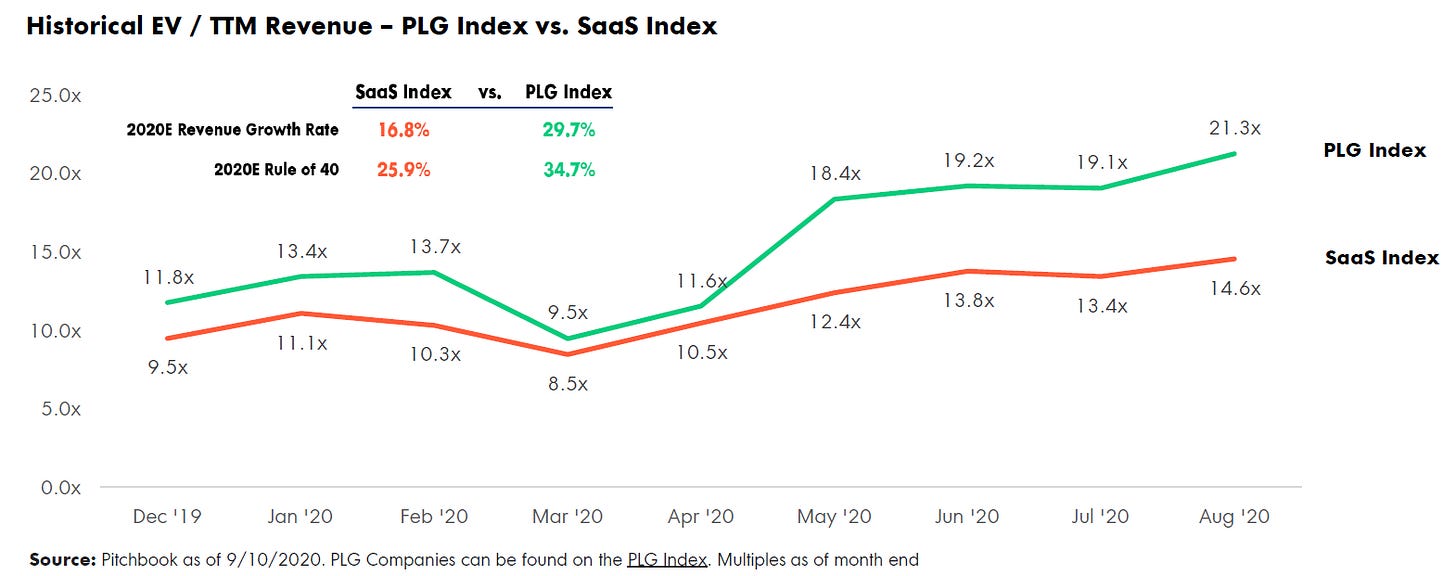

Public product led growth companies were already far outperforming their non-PLG SaaS peers pre-COVID. Now the differences are off the charts. PLG companies are trading at a 21.3x multiple of TTM revenue vs. 14.6x for the broader SaaS index; they have an average Rule of 40 of 34.7% vs. 25.9% for the broader SaaS index, and are growing at 29.7% YoY vs. 16.8% for the broader SaaS index. As my colleague Kyle Poyar wrote earlier, while Datadog, Zoom, Shopify, and Snowflake are certainly standouts right now, there are some bigger factors at play that benefit all PLG companies:

👉 Remote work has rapidly accelerated the pace of digital adoption. This has shortened sales cycles and increased the importance of time-to-value (where PLG companies shine).

👉 In Q1/Q2, buyers were hesitant to make big, expensive software commitments. But companies still needed software and opted for products where they could start for free or at a low cost.

👉 Remote work coincides with more flexible & less predictable schedules. PLG companies can take advantage because their products are "always on". Users can start a trial on their schedule - no need to wait for a demo.

Market Update

I enjoyed this piece covering public SaaS earnings. The analysis within largely supports what we’re finding in our SaaS benchmarks data (2020 report to be released in late October): companies reacted aggressively to COVID, and perhaps overreacted in hindsight. Demand for software has remained strong, which is also reflected in the astronomical public valuations and in this data from Citi Ed Sim covered. While all major indices are still up from their March 23rd lows (NASDAQ +59.14%, S&P +47.42, Dow +46.16%) I’d again reiterate to everyone that tech is in a world of its own. Only the NASDAQ has set new all-time highs this year (+14.74) - both the S&P and Dow are still -2.59% and -7.41% below their February 19th high water marks and +2.20 and -4.62 year to date respectively. These indices are more closely tracking the reality many non-tech companies have faced in their businesses due to the pandemic vs. what the NASDAQ is leading us to believe about performance over the last 6 months or so. It was a mixed bag of performance for key indices this week (SaaS +2.89%, Dow -1.75%, NASDAQ +1.96%, S&P 500 -0.63%).

Economic Data

In The Stock Market Is Less Disconnected From the “Real Economy” Than You Think, author and economist Nathan Tankus outlines a straightforward dis-aggregation of the what many refer to the “stock market” (S&P 500 index) to show most companies that aren’t generating sales are down YoY while most that are growing (tech) are up. The stock market isn’t the economy, but it is reflecting the economic reality better than many might believe as the above Market Update data gets at.

This week, Fed Chair Jerome Powell testified on in Congress alongside Treasury Secretary Mnuchin on fiscal stimulus and noted that “there is downside risk probably coming if some form of that support doesn’t continue.” Both men urged Congress to consider targeted relief that can be passed quickly, before getting to work on meatier partisan topics. Nevertheless, like everything, stimulus is facing a partisan divide.

What Else We’re Reading

Jump. The Mike Speiser Incubation Playbook. Should You Expect Sales Help from your VC. How to Pick a Term Sheet: 5-Step Framework for Quantifying VC Value Add. Invisible Asymptotes. The Outsiders. Betting Against Beta.